When you’re involved in a bad accident, sometimes the damage to your car is so extensive that your insurance company, after initial vehicle inspection, will deem it a “total loss”. What this essentially means is that it has been determined that the damage is so severe that it is not worth it to repair your vehicle but instead to “total it out” and pay you for the total loss of your car.

The determination as to whether your car, following an accident, is a total loss or not varies from state to state and insurance company to insurance company. However, a general rule that applies is if the damage exceeds a certain percentage of the car’s value it will typically be rendered a “total loss” and not repaired. These percentages vary from state to state but on average the percentage is between 50% and 70%.

What Criteria Are Used To Determine If Your Car Is A Total Loss?

Following a crash that results in property damages of any amount, the insurance companies involved will perform a total loss valuation, commonly referred to as a claim or insurance adjustment. Whether or not the vehicle is declared to be a total loss is determined by state law.

Florida uses the Total Loss Threshold (TLT) to calculate if a vehicle is a total loss following an accident. The Total Loss Threshold or TLT is the legal limit where an insurer must declare a motor vehicle totaled and acquire a salvage certificate of title or certificate of destruction.

The State of Florida’s Total Loss Threshold is 80 percent. This means if the damage to repair your vehicle exceeds 80% of the Actual Cash Value of your vehicle prior to the crash, it will be it is considered to be a total loss.

For example, if your vehicle before the accident was valued at $10,000.00 and as a result of the collision, it will cost $8,000.00 or more to repair the damages sustained that your vehicle will be deemed a total loss and you will be compensated for the “total loss” of your vehicle as opposed to repairing the damages.

Approximately half of the states a different method called the Total Loss Formula (TLF). This formula combines the repair costs with the salvage cost of the vehicle and when these figures exceed the Actual Cash Value at the time of the accident the car is determined to be a total loss.

Below is a list of all of the states and whether they use the Total Loss Threshold or the Total Loss Formula. The table also provides the percentage used by each state if it does use the Total Loss Threshold in determining if a vehicle is a “total loss.”

| State | TLT/TLF | State | TLT/TLF | state | TLT/TLF | state | TLT/TLF |

|---|---|---|---|---|---|---|---|

| Alabama | 75% | Indiana | 70% | Nebraska | 65% | South Carolina | 75% |

| Alaska | TLF | Iowa | 75% | Nevada | 50% | South Dakota | TLF |

| Arizona | TLF | Kansas | 75% | New Hampshire | 75% | Tennessee | 75% |

| Arkansas | 70% | Kentucky | 75% | New Jersey | TLF | Texas | 100% |

| California | TLF | Louisiana | TLF | New Mexico | TLF | Utah | TLF |

| Colorado | 100% | Maine | 75% | New York | 75% | Vermont | TLF |

| Connecticut | TLF | Maryland | TLF | North Carolina | 75% | Virginia | 75% |

| Delaware | TLF | Massachusetts | 75% | North Dakota | 75% | Washington | TLF |

| Florida | 80% | Michigan | 70% | Ohio | TLF | West Virginia | 75% |

| Georgia | TLF | Minnesota | TLF | Oklahoma | 60% | Wisconsin | 70% |

| Hawaii | TLF | Mississippi | 80% | Oregon | 80% | Wyoming | 75% |

| Idaho | TLF | Missouri | TLF | Pennsylvania | TLF | ||

| Illinois | TLF | Montana | 75% | Rhode Island | TLF |

How Is The Total Loss Of Your Car Valued Following A Total Loss Collision

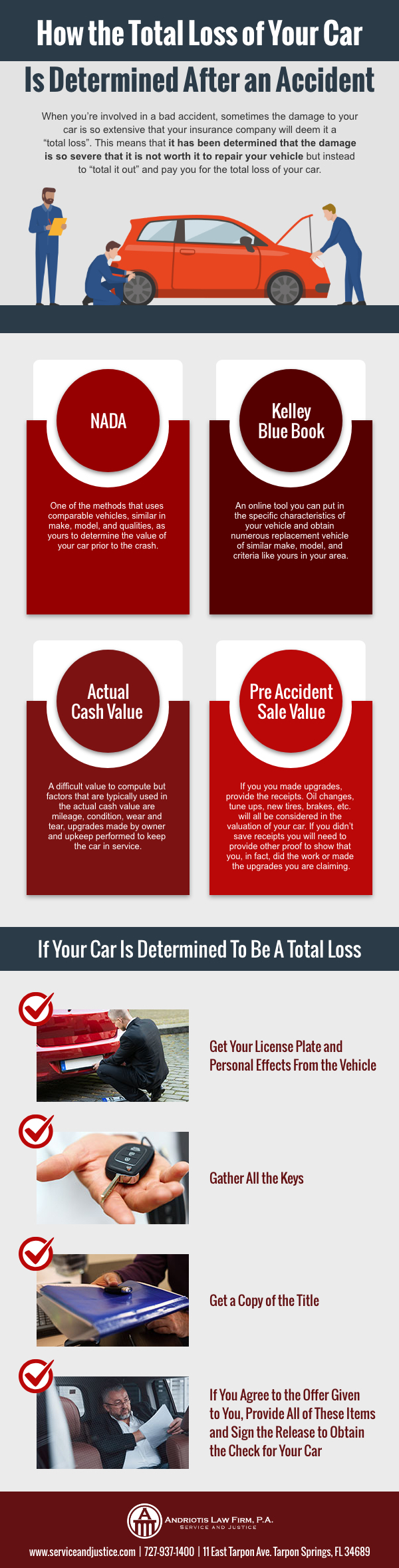

NADA

NADA is one of the methods used to calculate the replacement cost of your vehicle at the time of the crash. It uses comparable vehicles, similar in make, model, and qualities, as yours to determine the value of your car prior to the crash. It’s a good tool for determining if the offer given you by the insurance company is fair or out of line.

Kelley Blue Book

Kelly Blue Book is a commonly used online tool for evaluating the fair market value of your car at the time of the crash. You can put in the specific characteristics of your vehicle and obtain numerous replacement vehicles of similar make, model, and criteria like yours in your area.

This tool is often used to gauge whether or not the figure given you by the insurance company as an offer for your vehicle is fair or not and is also used in negotiations to increase the offer given to you.

Kelly Blue Book is proof of what your vehicle can be purchased for in your area and thus is often used for the replacement value of your car when valuing it after a “total loss.”

Actual Cash Value

Things that will help you with determining the actual cash value are receipts for part and repairs, pre-accident photos, and accurate service records.

When determining the actual cash value of your car it is often helpful to think of the process as being very similar to a real estate agent determining the value of a piece of property or home. Real estate agents will choose comparable homes in the area possessing similar characteristics to the home being valued and those comparables will be used in the determination of the home in question. The very same process is used in valuing your vehicle when deciding compensation for its loss.

Pre Accident Sale Value

Any Aftermarket Upgrades

Did you upgrade the rims, stereo, engine, etc.? If so, provide the receipts for the work you did, and these will be considered in the valuation of your car.

Recent Repairs

You Have Receipts

Oil changes, tune-ups, new tires, brakes, etc. will all be considered in the valuation of your car. Hopefully, you saved all receipts to make it easier to determine these being considered in your car’s value.

You Don’t Have Receipts

If you didn’t save receipts you will need to provide other proof to show that you, in fact, did the work or made the upgrades you are claiming.

If someone else did the work to your vehicles it is likely you can go and ask them for the receipts and proof that the work was actually done and the cost of said work.

You will need to provide some reliable proof that the upgrades or work you claim were done to your vehicle were actually done for them to be considered in the valuation of your car.

What To Do If Your Car Is Determined To Be A Total Loss

- Get Your License Plate And Personal Effects From The Vehicle

You will have an opportunity to get your personal effects and license plate from your car. Your vehicle will likely be stored at a salvage yard.

Provide ID and you will be allowed to gather all that you need from your vehicle.

- Gather All The Keys

You will be required to give the keys to your vehicle in exchange for a check. Because you will be giving up all the rights to your vehicle in exchange for a check for its total loss you will be required to give all that you have belonging to the vehicle.

- Get A Copy Of The Title

You will be required to sign over the title to your vehicle in exchange for a check. As stated before, you will be required to give up all rights to the vehicle in exchange for a check for its total loss.

- If You Agree To The Offer Given To You, Provide All Of These Items And Sign The Release To Obtain The Check For Your Car

After agreeing to the final offer given for your vehicle, signing over the vehicle’s title and giving the insurance company the keys you will be given a check for the amount agreed upon and required to sign a property damage release due to all property damage issues being settled and final.

Who Pays For The Total Loss Of Your Vehicle

You Were Not At Fault For The Accident

If you were not at fault for your accident the adverse party, who caused the accident, will be liable for the damage to your vehicle and the injuries sustained by you and all passengers of your car.

Adverse Party Had Insurance

If either the adverse driver or the owner of the vehicle they were driving, if it is a different person, have insurance, their insurance company/s will be responsible for the damage/ total loss of your vehicle.

Not Enough Coverage

An issue with coverage often arises when an at-fault driver is involved in an incident damaging multiple vehicles and doesn’t carry enough coverage to repair or replace all the cars involved. Usually, people carry the minimum Property Damage Coverage ($10,000.00 in the state of Florida) and this is not enough to compensate one total loss vehicle let alone two or more. In this instance, each person’s insurance must cover the difference between what the at-fault driver carried for property damage insurance and what the damage was to their vehicle.

Adverse Party Didn’t Have Insurance

If the at-fault party did not have insurance at the time of the incident, then your insurance company will have to pay for the total loss of your vehicle.

You can sue the at-fault driver for the amount of damage they caused and may be able to recover for your loss however people who do not carry insurance or adequate insurance typically do not have assets that you can recover against.

You Were At Fault For The Accident

If you were at fault for the crash than your insurance company will be responsible for the total loss of your vehicle including any damage you caused to other vehicles due to your negligence.

In this instance, you need to make sure you have enough coverage to cover damages you may cause as you could also be sued personally for damages you cause due to your negligence.

If you were uninsured at the time of your crash than you will personally liable for all damages you caused and will likely get your license suspended for being uninsured at the time of your collision.

What If You Owed More Than Your Car’s Value At The Time Of The Crash

Many times people owe more for than vehicles than they are worth and this will become apparent when involved in a total loss collision as the fair-market payment for your vehicle’s total loss will not cover what is owed for your vehicle.

You Had Gap Insurance

If you have gap insurance, then this insurance coverage will cover the difference between fair market value and what is owed.

You Didn’t Have Gap Insurance

If you did not carry gap insurance at the time of the collision then you will be responsible for the difference between the fair market value of your vehicle and what you owe.

If You Don’t Agree With The Insurance Company’s Offer

Send Proof Of Why You Disagree

Do some research on your car’s value to determine if the insurance company is making you a fair offer. If they are making a fair offer you should agree to accept it and, often, fair offers are made in total loss collisions.

If they have not made you a fair offer than you can use this research you’ve done on your car’s value as a negotiation tool to increase the offer originally made.

Make A Counteroffer

If you’re not satisfied with the offer made, make a counteroffer and continue to negotiate the offer until you are satisfied.

If the insurance company never makes a fair offer for your total loss vehicle than you can either choose to cut your losses and accept the offer given or you can file a lawsuit to get the fair market value of your car.

Negotiate Other Factors

Rental Car Time

You may wish to negotiate how much time you will get a rental car while the negotiation process goes on but will typically be held a reasonable time limit to accept or reject the insurance company’s offer. Typically, within a week there should be some sort of agreement or not.

Speed Of Check

You can also ask for the check to be expedited and often time the insurance company’s adjuster will comply with this request.

If You Agree With The Insurance Company’s Offer

Formally Accept

Review the Release provided after agreeing to an amount for your total loss and make sure the Release only releases the insurance company for property damage only and not anything else. Examples of other things insurance companies try to include in property damage releases are injuries sustained to your person as a result of the crash.

Can I Keep The Car Myself?

Sometimes the insurance company will let you keep your vehicle in addition to providing you a check for its total loss. This is also something you can negotiate during the process.

What Happens If I Have To File A Lawsuit?

If you have to file a lawsuit to recover for your total loss vehicle you will need to hire experts to attest to the vehicle’s pre-accident value and also provide exhibits substantiating why you deserve the amount you are requesting.

I strongly suggest hiring an attorney if you have to file suit as a result of not getting a fair offer for your total loss vehicle.

JD Power Study Ranking Insurance Companies For Fairness In The Settlement Process

| Company | Score Out of 10 (Settlement and Appraisal Process) |

|---|---|

| Auto-Owners, USAA, Amica Mutual | 10 |

| NJM Insurance Company | 8 |

| Nationwide, Allstate, The Hartford | 7 |

| Farmers, GEICO, State Farm, Progressive, Safeco, American Family, Erie, Liberty Mutual, Travelers | 6 |

| Mercury, Country, Hanover, 21st Century | 5 |

| Automobile Club Group, MAPFRE, Esurance | 4 |

How Can An Lawyer Help Me

All Handled By Your Lawyer

The entire process, from gathering information of your car’s value to negotiating the settlement and reviewing the Release, can be handled by your attorney should you choose to hire one.

Attorney represented clients many more times than not get higher settlement offers and settle their property damage claims much quicker than people who are unrepresented.

Typically With Extensive Property Damage, There Are Also Associated Injuries

Get Medically Checked Out

Following an accident, you should always get examined medically for any injuries.

This is the case whether you were at-fault or not. Being that Florida is a no-fault state, you have the right to get medically examined following an accident without repercussion.

Get Proper Value For Your Car Without The Hassle

Our office can relieve the stress and take over the hassle of taking care of your total loss vehicle. Our staff is highly skilled in evaluating a vehicle following a total loss collision and is prepared to take all the steps necessary to make sure you are quickly and fairly compensated for your vehicle in every way possible.