A Guide to Property Damage Repairs After an Auto Accident

If you’ve been involved in an automobile accident, one of the first things you will notice, aside from the aches and pains your body is experiencing from your injuries, is the damage to your vehicle. At a minimum, it may have been left with minor dings, scratches and dents or, worst-case scenario, it could be a total loss and/or undrivable.

The process of getting an automobile repaired can be confusing, scary, and complicated while leaving you at the mercy of insurance companies who, for the most part, do not have your best interests in mind. This process is one riddled with questions, steps, and procedures where each one determines how the next will go and so on and so forth.

As personal injury professionals, we also have become adept at navigating the confusing procedures insurance companies have made to get your vehicle repaired. Sometimes after the process is complete, a victim is left with more questions than answers, their vehicle is still not in the condition it was prior to the accident, and they have been forced to pay for parts of the repair process they shouldn’t have and are not legally required to pay for.

Although the property damage repair process is complicated, it is our intention to explain it as best we can so you are informed in the event you are forced to navigate this process.

Getting Your Car Towed after an Accident

- Who is going to tow your car from the scene of an accident and pay for storage fees if it’s not drivable?

- How do I get a rental car so I can still go to work, school or do my normal daily activities?

- Who is going to fix the car?

- Who is going to pay for the repairs?

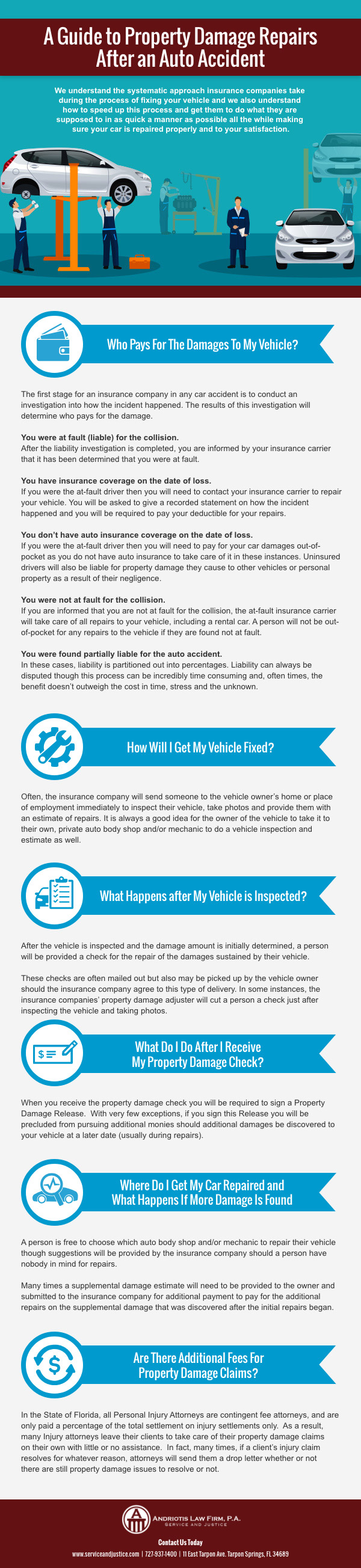

As Accident/Personal Injury Attorneys we understand the step-by-step process necessary to get your car fixed and get you safely back on the road again. We understand the systematic approach insurance companies take during the process of fixing your vehicle and we also understand how to speed up this process and get them to do what they are supposed to in as quick a manner as possible all the while making sure your car is repaired properly and to your satisfaction.

The various things affecting all auto accident damage claim and how and who will pay for the damages incurred are primarily determined by who was at fault for the accident. Secondly, but just as important, is whether or not there was the correct type of insurance coverage to meet the needs of the damages sustained and was there enough coverage.

The detailed outline and explanation below will help you understand the twists and turns of how property damage to your vehicle is fixed, who pays for this and how these repairs all happen.

How to Navigate Property Damage to Your Vehicle

Who Pays For The Damages To My Vehicle?

The first stage for an insurance company in any car accident is to conduct an investigation into how the incident happened. The results of this investigation will determine who pays for the damage.

This investigation process includes the following:

-

- 1 .Obtaining the police report to see the investigating officer’s findings.

-

- 2. Talking to any witnesses who may have seen the collision.

-

- 3. Conducting recorded statements with all the drivers of the vehicles involved.

-

- 4. Investigating the scene for the accuracy of the statements made.

-

- 5. Looking at the property damage of both vehicles to see if the resulting property damage matches up with the statements given.

After the investigation is complete, the insurance companies will determine who will pay for the damages sustained in the incident by determining who was at fault. The at-fault driver’s insurance will be liable for the damages resulting from their insured’s negligence and all affected vehicles will be repaired using the at-fault insurance companies’ Property Damage Liability Coverage.

Often, the at-fault driver’s insurance company uses the excuse that they haven’t had an opportunity to speak with their insured. Insurance companies have a contractual duty to get their insured’s version of how the accident happened before paying out benefits to the non-at-fault driver’s vehicle.

To avoid any delay, you may want to use your own insurance company to avoid any inconvenience during this delay and then the at-fault insurance company will reimburse your insurance company in a process called subrogation after liability is determined and the at-fault insurance company has agreed to pay the property damages sustained by other reasons.

Virtually all insurance decisions flow from the outcome of their liability investigation following the car crash where there are only three outcomes. A person involved in an auto accident will be found to be either liable for the crash in total, not liable for the crash at all or may also be found partially liable depending on the facts surrounding the incident.

You were at fault (liable) for the collision.

After the liability investigation is completed, you are informed by your insurance carrier that it has been determined that you were at fault. Assuming you do not dispute this liability finding you must do the following:

You have insurance coverage on the date of loss

If you were the at-fault driver then you will need to contact your insurance carrier to repair your vehicle.

- You will be asked to give a recorded statement on how the incident happened. You are required under the terms of your contract with your insurance company to provide them with this recorded statement and if you do not comply then your coverage will be denied, and your insurance policy will be null and void.

- You will be required to pay your deductible for your repairs, and it is also very likely that your insurance premium will increase due to you being involved in an auto collision.

You don’t have auto insurance coverage on the date of loss

If you were the at-fault driver then you will need to pay for your car damages out-of-pocket as you do not have auto insurance to take care of it in these instances.

- Uninsured drivers will also be liable for property damage they cause to other vehicles or personal property as a result of their negligence.

You were not at fault for the collision.

After the liability investigation is completed and you are informed that you are not at fault for the collision, the at-fault insurance carrier will take care of all repairs to your vehicle, including:

- supplemental damage discovered (discussed later),

- rental car during the repair process, and

- they will also be responsible for any deductibles you may have had to pay.

A person will not be out-of-pocket for any repairs to the vehicle if they are found not at fault. The only circumstance where a driver not at fault in a collision will be liable for property damage repairs, deductibles, etc. will be when the at-fault driver either is uninsured or does not carry enough insurance to make the necessary repairs caused by them in the collision.

In this instance, a person’s own insurance will come in and take care of all the repairs in the instance the at-fault driver is uninsured or the difference in the instance the at-fault driver did not carry enough insurance coverage.

You were found partially liable for the auto accident.

In rare cases, there are instances where after an investigation it is concluded that both parties are each liable to a certain degree. The insurance company comes to this conclusion following an investigation when they feel that both parties are at-fault due to each party having some responsibility for the crash.

In these cases, liability is partitioned out into percentages (80-20, 90-10, 50-50) are just a couple examples of how the insurance companies partition liability in these instances. Liability can always be disputed though this process can be incredibly time consuming and, often times, the benefit doesn’t outweigh the cost in time, stress and the unknown.

How Will I Get My Vehicle Fixed?

In the event someone is involved in an auto accident, they will need to have a professional inspect their vehicle and provide an estimate of the damages sustained and how much it will cost to repair these damages. Often, the insurance company will send someone to the vehicle owner’s home or place of employment immediately to inspect their vehicle, take photos and provide them with an estimate of repairs.

It is always a good idea for the owner of the vehicle to take it to their own, private auto body shop and/or mechanic to do a vehicle inspection and estimate as well. Many times, these estimates will differ as it is the insurance companies’ incentive to lessen the monetary damage to a person’s vehicle in an effort to save what benefits they pay out.

What Happens after My Vehicle is Inspected?

After the vehicle is inspected and the damage amount is initially determined, a person will be provided a check for the repair of the damages sustained by their vehicle.

These checks are often mailed out but also may be picked up by the vehicle owner should the insurance company agree to this type of delivery. In some instances, the insurance companies’ property damage adjuster will cut a person a check just after inspecting the vehicle and taking photos.

What Do I Do After I Receive My Property Damage Check?

When you receive the property damage check you will be required to sign a Property Damage Release. With very few exceptions, if you sign this Release you will be precluded from pursuing additional monies should additional damages be discovered to your vehicle at a later date (usually during repairs).

Getting Your Car Repaired After an Accident

Where Do I Get My Car Repaired?

Now the owner has to make a decision on where they would like their vehicle repaired. A person is free to choose which auto body shop and/or mechanic to repair their vehicle though suggestions will be provided by the insurance company should a person have nobody in mind for repairs.

After a person determines where the vehicle will be repaired at the next step will be to drop off the vehicle for repairs and obtain a rental car while it is being repaired.

What Happens If More Damage Is Found?

During the repair process of a person’s vehicle, many times additional damage is found that was either not visible during the initial inspection or resulted from the repair of already damaged parts. Either way, these additional damages which have now been discovered need to also be repaired and paid for by the insurance company.

In the event additional damages are discovered, a supplemental damage estimate will need to be provided to the owner and submitted to the insurance company for additional payment to pay for the additional repairs on the supplemental damage that was discovered after the initial repairs began.

Are There Additional Fees For Property Damage Claims?

If a person has an injury claim in addition to their property damage claim, will they be charged attorney’s fees for their property damage claim?

In the State of Florida, all Personal Injury Attorneys are contingent fee attorneys, and are only paid a percentage of the total settlement on injury settlements only. As a result, many Injury attorneys leave their clients to take care of their property damage claims on their own with little or no assistance. In fact, many times, if a client’s injury claim resolves for whatever reason, attorneys will send them a drop letter whether or not there are still property damage issues to resolve or not.

The Andriotis Law Firm follows a different approach when it comes to handling property damage claims. We ALWAYS help our clients with property damage claims from start to finish regardless of the fact that we do not get a fee for this help. We just feel this is the right thing to do.