When a person is involved in an accident, often their vehicle becomes damaged to the point that it requires extensive repairs and sometimes the damage is so great that the vehicle is a total loss. Either way, there will be some period of time where they will be without the luxury of their vehicle, and this is where loss of use comes into play.

Should your vehicle be damaged but repairable your loss of use claim will be for the duration of time that you are without your vehicle while it is being evaluated and repaired.

Should your vehicle be considered a total loss than your loss of use claim will be for the duration of time that you are without your vehicle and waiting for compensation for the total loss. In this scenario, once you receive the check compensating you for the total loss of your vehicle your loss of use claim will end.

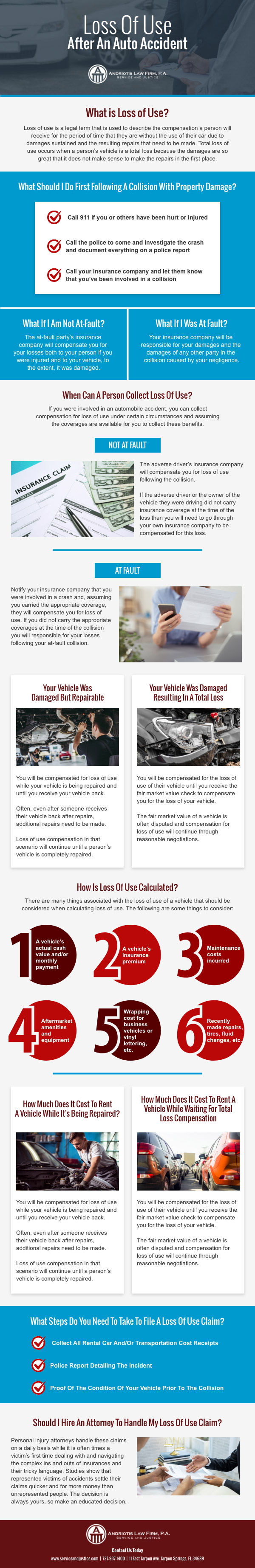

Loss of use is a legal term that is used to describe the compensation a person will receive for the period of time that they are without the use of their car due to damages sustained and the resulting repairs that need to be made. Total loss of use occurs when a person’s vehicle is a total loss because the damages are so great that it does not make sense to make the repairs in the first place.

When a person suffers the loss of use of their vehicle for any period of time, they have the ability to be compensated for a rental car, public transportation and/or any other reasonable transportation expenses incurred as a result of the loss of use of their vehicle and/or transportation means. Typical reasonable transportation means are busses, taxis, Ubers, etc.

What Should I Do First Following A Collision With Property Damage?

The first thing you should do following any collision, including those with property damage and/or personal injury, is to call 911 if you or others have been hurt or injured. If nobody has sustained any injuries call the police to come and investigate the crash and document everything on a police report. Additionally, you will need to call your insurance company and let them know that you’ve been involved in a collision. Completing these steps will start the process of getting your claim documented and started and put you on a path to recovering for your loss.

What If I Am Not At-Fault?

If you were not at fault for the collision than the at-fault party’s insurance company will compensate you for your losses both to your person if you were injured and to your vehicle, to the extent, it was damaged. This includes Loss of Use for your vehicle during the period of time you will be without it while it is being repaired or while you are without your vehicle and waiting to be compensated should it be a total loss.

The determination on fault will be made by the officer who will use the testimony of all drivers involved in the collision, any witnesses who saw the crash and any surveillance footage, should there be any. You can dispute the liability decision of the officer but will need compelling evidence to dispute the facts as the officer saw them.

This evidence usually comes in the form of additional testimony of witnesses and/or direct contradictory evidence to any testimony given. An example would be that a witness states that a driver was braking hard and skidded into another vehicle, yet you take photos of the scene and there are no skid marks left on the pavement. This evidence can be used to contradict the evidence of skidding and in essence, nullify the testimony of a witness who clearly does not remember the accident correctly.

What If I Was At Fault?

If you were at fault for a collision, then you will need to notify your insurance company and notify them of the facts of the collision and your insurance company will be responsible for your damages and the damages of any other party in the collision caused by your negligence.

Should you have failed to carry rental car coverage you will not be compensated for the loss of use of your vehicle should you be found at fault for the crash. In this case, you will have to absorb the loss of use personally as there is no coverage which would apply in this situation to assist you for a loss given this scenario.

You will still need to notify your insurance company of the incident as you have a contractual duty in your signed-contractual-agreement to notify them whenever you are involved in a crash or incident regardless of fault. If you fail to do so your insurance company reserves the right to cancel your policy and refund you the prorated amount for the time remaining on your contract.

When Can A Person Collect Loss Of Use?

If you were involved in an automobile accident, you can collect compensation for loss of use under certain circumstances and assuming the coverages are available for you to collect these benefits.

Not at fault – if you are not at fault than the adverse driver’s insurance company will compensate you for loss of use following the collision. If the adverse driver or the owner of the vehicle they were driving did not carry insurance coverage at the time of the loss than you will need to go through your own insurance company to be compensated for this loss.

- At fault – if you were at fault for the collision then you will need to notify your insurance company that you were involved in a crash and, assuming you carried the appropriate coverage, they will compensate you for loss of use. If you did not carry the appropriate coverages at the time of the collision you will responsible for your losses following your at-fault collision.

Your Vehicle Was Damaged But Repairable

When someone is involved in a crash resulting in property damage to their vehicle that is repairable, they will be compensated for loss of use while their vehicle is being repaired and until they receive their vehicle back.

Often, even after someone receives their vehicle back after repairs, additional repairs need to be made. In this instance, they will need to take the vehicle back for those additional repairs to be made.

Loss of use compensation in that scenario will continue until a person’s vehicle is completely repaired.

Your Vehicle Was Damaged Resulting In A Total Loss

When a person is involved in a crash resulting in a total loss of their vehicle due to the severity of the damages sustained, they will be compensated for the loss of use of their vehicle until they receive the fair market value check to compensate them for the loss of their vehicle.

The fair market value of a vehicle is often disputed and compensation for loss of use will continue through reasonable negotiations.

Reasonable negotiation is an ambiguous term and thus the legal reasonable person standard is used to define it.

How Is Loss Of Use Calculated?

There are many things associated with the loss of use of a vehicle that should be considered when calculating loss of use. The following are some things to consider:

2. A vehicle’s insurance premium

3. Maintenance costs incurred.

4. Aftermarket amenities and equipment (DVD player, tow hitch, stereos, etc.)

5. Wrapping cost for business vehicles or vinyl lettering, etc.

6. Recently made repairs, tires, fluid changes, etc.

How Much Does It Cost To Rent A Vehicle While It’s Being Repaired?

Your vehicle or one similar – you are permitted to rent a vehicle of like make and model to the one being repaired.

For instance, if you were driving a van then you can rent a van or SUV but if you were driving a compact car you will not be compensated for renting a large SUV.

How Much Does It Cost To Rent A Vehicle While Waiting For Total Loss Compensation

Your vehicle or one similar – similar to the instance of a person’s car being repaired, you are permitted to rent a vehicle of similar make and model to the one that was a total loss and any vehicle which veers from this will not be compensated.

What Steps Do You Need To Take To File A Loss Of Use Claim?

✓ Rental Car And/Or Transportation Cost Receipts

Keep all receipts for renting the vehicle and provide those to the insurance company as documentation that you did rent a vehicle.

✓ Police Report Detailing The Incident

For liability purposes, you will need the police report and/or witness statements. As discussed earlier, this evidence is necessary to determine liability, and this liability determination is used to determine who is liable for paying a person’s loss of use.

If the police are not called, make sure to get all of the adverse driver’s information, including a statement if possible, to assist in the liability determination.

Sometimes, the at-fault driver will change their story following an accident from what it was at the scene in hopes of not being liable and for fear their insurance premiums will increase. This is why it is very important to document, to the best of your ability, the incident.

✓ Proof Of The Condition Of Your Vehicle Prior To The Collision

Photos, repair receipts, and eye witness testimony are the best indicators of the condition of a person’s vehicle before an accident. The more proximate the photos are to the incident the better they are as proof of the vehicle’s condition.

Should I Hire An Attorney To Handle My Loss Of Use Claim?

Personal injury attorneys handle these claims on a daily basis while it is often a victim’s first time dealing with and navigating the complex ins and outs of insurances and their tricky language. Studies show that represented victims of accidents settle their claims quicker and for more money than unrepresented people. The decision is always yours, so make an educated decision.

Not at fault – if you are not at fault than the adverse driver’s insurance company will compensate you for loss of use following the collision. If the adverse driver or the owner of the vehicle they were driving did not carry insurance coverage at the time of the loss than you will need to go through your own insurance company to be compensated for this loss.

Not at fault – if you are not at fault than the adverse driver’s insurance company will compensate you for loss of use following the collision. If the adverse driver or the owner of the vehicle they were driving did not carry insurance coverage at the time of the loss than you will need to go through your own insurance company to be compensated for this loss.