Usually the first stall tactic a company will use to delay payment is to make a “lowball” offer on your claim. This is done for three reasons: to test the insured’s resolve in pursuing the full fair value of their settlement, to erode that resolve through delay, and to hopefully settle your claim, if your accept this offer, for much less than its full fair value. Insurance companies know that a statistically significant portion of people accept the small money and run. Failing that, the next stage of the process is usually negotiation.

The basic rule of thumb regarding personal injury cases is that, in an ideal negotiation, an agreeable settlement will be reached that is comparable to what the case would have settled for in a jury trial. Many factors go into this: the geographic area, type of injury, and degree of injury. But an insurance company will try to never pay more than what they think they might potentially lose in litigation if the case can’t be settled out of court.

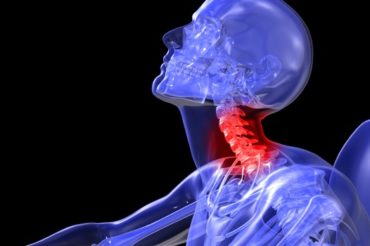

In the particular case of soft-tissue injuries and injuries that are not visible to the naked eye, an insurer may try to drag the case out, as these injuries are harder to prove without expensive MRI testing. The critical element of proof is causality: was your herniated disc, for example, caused by the accident in question? Obvious injuries such as a broken bone or dismemberment are plainly visible to a jury, but for soft tissue injuries, there will likely be arguments regarding causality between your attorney and the insurance company.

But another important reason that a company may delay payment on your insurance claim speaks to the financialization of our economy.

Let’s back up a second here: what is insurance, anyway? Well, one way of thinking about the transaction contained in an insurance policy is “capital willing to take risk.” The company is risking its capital up to the limits of your policy in the event of a claim. In exchange, you pay them a premium, which is their reward for taking that risk on you. But they’re not just making money from your premiums. No, an insurance company also makes use of a diversity of other financial vehicles such as stocks & bonds to make money on its existing cashflow. That money you’re expecting them to pay you, they’re also using to make money in other ways. If they delay each payout by even a few days on each car accident, they can reap significant additional profits.

That being said, insurance companies obviously have no incentive to quickly pay their claims. An experienced attorney who knows the process is the best way to speed it along. With all the different circumstances that go into a case, only an attorney will have a proper answer to your particular problem.